Staying up-to-date with ZATCA regulations can be a complex task for businesses in Saudi Arabia. However, integrating your existing Odoo system with specialized ZATCA modules can dramatically simplify the process. This integration allows you to optimize key functions, such as invoice generation, tax calculation, and reporting, ensuring seamless alignment with ZATCA mandates. By leveraging Odoo's robust features and the power of specialized integrations, businesses can proactively manage their VAT obligations, minimizing risks and maximizing operational efficiency.

Odoo: Your All-in-One for ZATCA Tax Automation

Streamline your tax processes and ensure compliance with the ZATCA regulations using Odoo, a robust and versatile ERP system. Odoo's functionalities provide you to automate various aspects of tax management, from invoice generation and reporting to e-filing and payment processing.

Utilizing Odoo's powerful features, businesses can simplify their ZATCA compliance, minimizing the risk of penalties and ensuring accurate tax reporting.

- Odoo provides a unified platform to manage all your ZATCA obligations.

- Simplify invoice generation and Sales tax calculations with accuracy.

- Create comprehensive tax reports effortlessly for timely submission to ZATCA.

With implementing Odoo, businesses can enhance their tax management processes, leading to improved efficiency and reduced compliance risks.

Streamlined ZATCA E-Invoice Generation and Management in Odoo

Embracing the digital transformation of accounting, ZATCA's mandate for e-invoicing presents a significant opportunity for businesses to enhance their processes. Odoo, a comprehensive business management solution, offers a powerful platform to automate ZATCA e-invoice generation and management, ensuring conformance with regulations while enhancing operational efficiency.

- Utilizing Odoo's advanced e-invoicing module, businesses can create compliant invoices that satisfy ZATCA's stringent requirements.

- Automated invoice issuance processes minimize manual tasks, freeing up valuable time for businesses to focus on essential activities.

- Instantaneous tracking and reporting of invoices provide valuable information into revenue, enabling informed decision-making.

Furthermore, Odoo's protected platform ensures the privacy of sensitive financial data, reducing the risk of fraud.

Effortless Zakat Calculation and Reporting with Odoo

Managing Zakat obligations can often be a daunting task. Yet, with Odoo's comprehensive features, calculating and reporting your Zakat has become effortless. The robust software automates the entire process, ensuring accuracy and saving you valuable time and effort.

- Streamline your Zakat calculation with ease using Odoo's intuitive interface.

- Produce detailed Zakat reports instantly for your records and regulatory filings.

- Keep compliant with Islamic principles by leveraging Odoo's accurate Zakat calculation methodology.

Additionally, Odoo integrates seamlessly with other business functions, providing a holistic view of your finances and simplifying overall management. Embrace the power of Odoo to make Zakat payment a seamless and worry-free experience.

Optimize Your Tax Compliance with Odoo and ZATCA

In today's dynamic business landscape, ensuring seamless compliance with tax regulations is paramount. The integration of Odoo ERP system through the ZATCA platform presents a powerful solution for businesses operating in Saudi Arabia. This website strategic partnership optimizes key tax processes, such as invoice creation, tax calculation, and filing. By leveraging the comprehensive functionalities of both systems, businesses can drastically reduce their administrative responsibility. Moreover, Odoo's user-friendly interface enhances tax management, making it accessible to businesses of all dimensions.

- Leveraging the ZATCA API, Odoo facilitates real-time data synchronization, ensuring accurate and up-to-date tax records.

- Automated processes reduce manual intervention, minimizing human error and saving valuable time.

- Gaining actionable insights from integrated reports enables businesses to make informed decisions regarding tax planning and compliance.

Odoo: A Comprehensive Solution for VAT Management

In today's increasingly complex global marketplace, businesses face the challenge of navigating intricate tax regulations. Value Added Tax (VAT) compliance can be a particularly time-consuming task, requiring meticulous record-keeping and thorough calculations. Fortunately, Odoo, a powerful cloud-based ERP system, offers a comprehensive solution for VAT automation.

Odoo's integrated VAT module streamlines the entire VAT process, from invoice generation and tracking to reporting and reconciliation. It provides users with instantaneous insights into their VAT liabilities, allowing them to make informed choices.

- ,In addition to, Odoo seamlessly integrates with ZATCA (Zakat, Tax and Customs Authority) systems, ensuring smooth data exchange and fulfillment with Saudi Arabian tax regulations.

- This, the system's user-friendly interface makes it accessible to businesses of all sizes, regardless of their technical proficiency.

By leveraging Odoo's powerful features, businesses can effectively handle their VAT obligations, optimize their tax efficiency, and focus on core business activities.

Luke Perry Then & Now!

Luke Perry Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Brandy Then & Now!

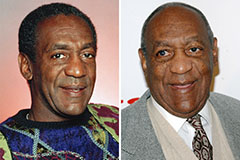

Brandy Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!